Key Takeaways from the Student Loan Marketplace in 2022

To say it’s been an interesting year in student loans would be to put it mildly. As 2023 begins, we want to first wish you all the best in the New Year. Next, because student loans are what we do, we wanted to summarize the key takeaways from the marketplace in 2022, and outline some expectations for 2023:

Biden Debt Cancellation

Let’s start with the biggest headline in student loans today, the President’s cancellation plan. If successful, it would mark a permanent shift in the executive branch’s role in student loan initiatives and become the largest student loan “handout” ever (much to the chagrin of some taxpayers). If this cancellation happens it will set a new precedent, and more debt forgiveness may follow. But this is a big “if” as the stage is set for an historic showdown between the executive and judicial branches. While student loans may be the topic, this case presents a much larger question about executive power and potential overreach.

The CARES Act: It’s the gift that keeps on givin’.

Cousin Eddie said it best about a one-year subscription to the jelly-of-the-month club. In the case for borrowers, the savings from the interest and payment halt is much more substantial. Consider a $100k loan balance at a 6% rate (which was set to 0% in March 2020 and remains so until at least April): Over three years, $18,000 of interest savings is accumulated. In aggregate, the cost of the halt is approaching $200 billion. By contrast, the cost of President Biden’s proposed loan cancellation plan detailed above is projected to be $400 billion.

The PSLF Limited Waiver has Changed the Narrative

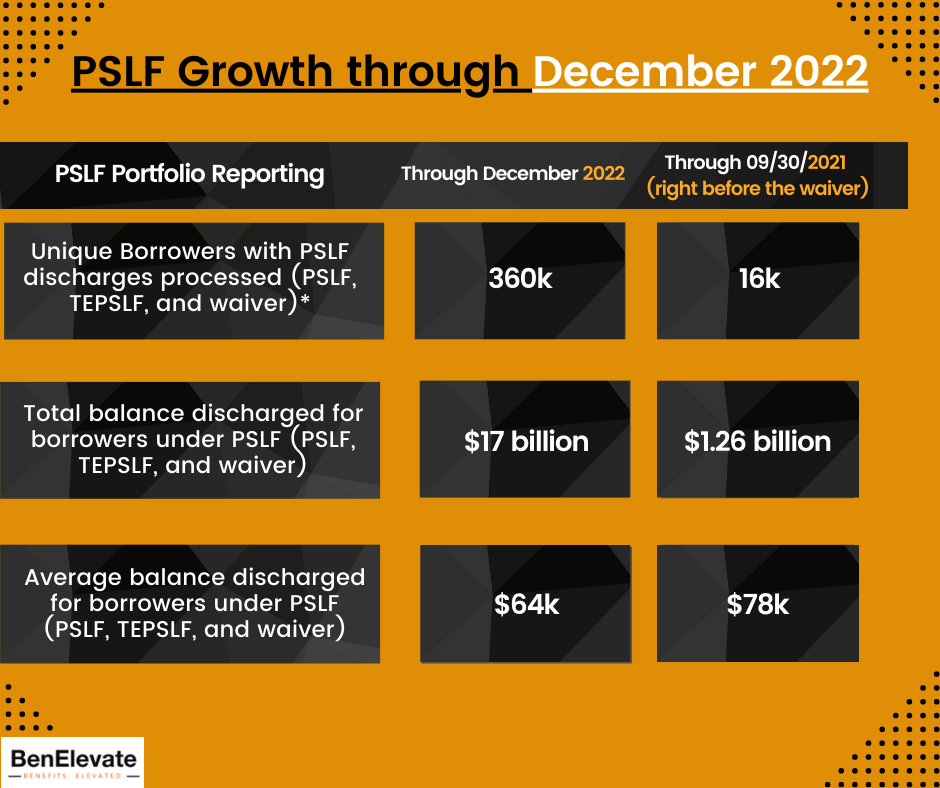

Gone are the days of borrowers receiving denials on their PSLF applications as the rule; it is now the exception. Check out the statistics below on PSLF success before the waiver, and then through this month.

Even better, the core components of the waiver have been extended out to July of 2023, so there’s still time to act if you have not been reading our updates for the past year (which we know you wouldn’t dare!).

A New Income-Driven Repayment (IDR) Plan?

On the same day the President announced his loan cancellation plan, new IDR plan was also presented which would reduce monthly payments to as little as 5% of discretionary income for some borrowers. To date (12/28/22), ED still has not released the full details of the plan, which were due back in November. This plan also offers a higher poverty level deduction, lower payment multiplier, and no interest accrual beyond the payment amount… which can result in much greater savings and simplicity than the existing plans.. We’re awaiting more detail, but we anticipate this plan going live July 1st. There’s still plenty of time to work out the details and see if it should be integrated into your strategy, so stay tuned for future updates.

Sorry, Comments are closed!