We apologize for the cheesy, Halloween-inspired subject line. But if you’ve been following our recent updates, this news shouldn’t be scary anyway…

A US Appeals Court confirmed last week that the SAVE plan will likely remain blocked until its legality is decided, with a court ruling expected before year-end (and oh yeah, a Presidential election looming in the meantime).

Extended Forbearance for SAVE Plan Enrollees

With the SAVE plan still under review, the Department of Education has extended the interest-free forbearance for another six months. This time will still NOT count toward forgiveness, but we suggest sticking with SAVE if you’re already enrolled. The PSLF Buyback should be available after the court’s decision, and new guidance might even extend benefits to additional participants.

Income Recertification Resumes in November

The SAVE forbearance does NOT excuse borrowers from keeping their income documentation up to date. After a 4.5-year break, income recertification is set to resume in November for borrowers in ALL income-driven repayment plans. Your servicers will reach out to gather updated income details if they haven’t already.

Forgiveness Milestone Reached? Here’s What to Expect

Due to the recent legal challenges, forgiveness through ICR, PAYE, and REPAYE/SAVE is temporarily paused—even if you’ve reached a forgiveness milestone through the final IDR account adjustment. If this applies to you, you’ll remain in an interest-free forbearance until the court issues a final decision. We don’t believe your forgiveness is at risk; it’s just temporarily delayed.

Online Applications Now Available for IDR and Consolidation

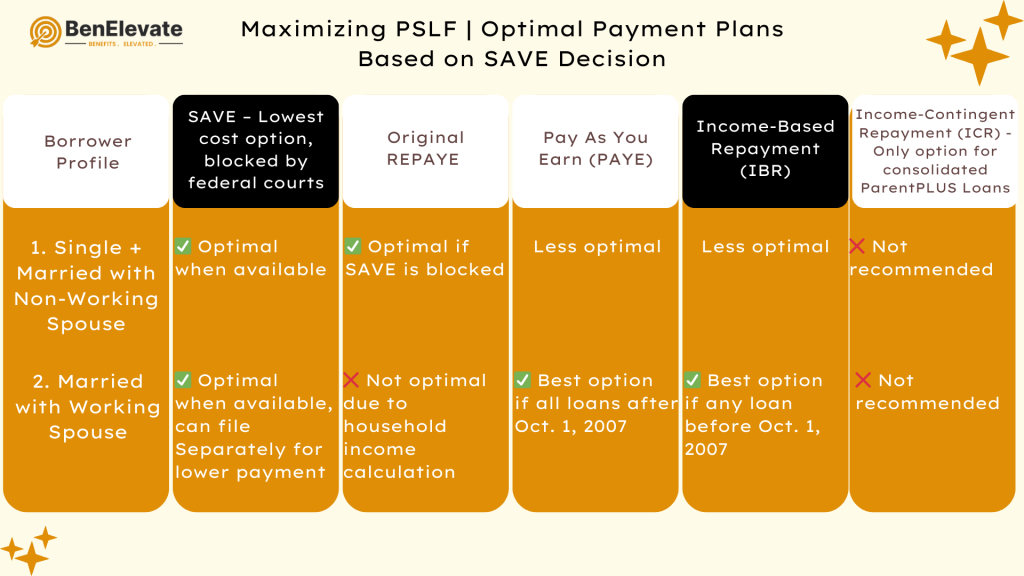

The IDR and consolidation applications at studentaid.gov are live again, allowing you to switch plans or consolidate loans as needed. For those considering SAVE or REPAYE, keep in mind the ongoing legal uncertainty before making any changes. Currently, only IBR and SAVE are available options, as ICR and PAYE were phased out this summer. We expect the latter two programs to be reinstated as alternatives this Fall if SAVE remains blocked. The following chart highlights the optimal Income-Driven plan based on the future availability of SAVE and your tax status:

We know this ongoing complexity and evolving legislation can be confusing and intimidating, and that loan servicers are overwhelmed and unable to assist you. We invite you to schedule a 1:1 meeting with us to review your strategy, retroactive qualifications, tax filing implications, and recertification options based on your specific profile:

PSLF Analysis & Support Session: CLICK HERE

BenElevate Clients: If your employer is a BenElevate client, your HR can provide you the link to register with us at no cost!

‘til DEBT do us part,

Sorry, Comments are closed!