Fall Student Loan Marketplace Update

The End of the CARES Payment Halt

After a 3 ½ year payment (and accruing interest) hiatus, student loan payments resumed in late 2023. It took a debt ceiling deal to codify that the CARES payment halt couldn’t be extended again, barring a new emergency (let’s not hope for this).

It should be noted that the end of the CARES payment halt was not connected to the Supreme Court decision on cancelling up to $20k of student debt for borrowers under $125k single (or $250k household) income. This was denied, and President Biden is now pursuing a different path to providing broad loan cancellation for borrowers under certain income thresholds. Even if your income exceeds these thresholds, multiple opportunities for savings and relief exist today.

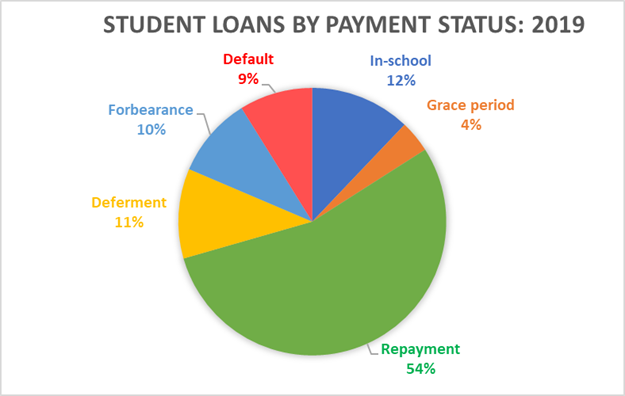

Economic Ruin? We Think Not. While media headlines suggested that the resumption of student loan payments will “send 40 million borrowers into a downward spiral and push us towards economic ruin” (I’m paraphrasing several articles), let’s put this into perspective… Looking back to 2019, pre-CARES, 19% of borrowers were in default or forbearance. The other 81% were in school, in a qualified Deferment, or in repayment:

Additionally, early-career graduate health professionals who need payment relief today have access to more forgiveness and subsidy programs now than before CARES. Participation in Income-Driven Repayment (IDR) plans, which limit payments to as little as 10% of a borrower’s discretionary income, are widely used today to decrease a borrower’s debt burden.

Legislative Changes

A new Income-Driven Repayment (IDR) Plan

The best news in federal loan repayment that we saw last year did NOT get the coverage it deserved. In early 2023, the Department of Education proposed a new IDR plan that would lower payments for all borrowers (and increase PSLF savings) by reducing the required payment on undergraduate debt to 5% of Discretionary Income (DI), and increasing the poverty level multiple from which DI is calculated. Graduate-level debt will remain at 10%.

Example: A borrower making $65k/year or less in a family size of 4 would have a monthly “payment” of $0 under the new plan (today, that borrower would pay roughly $100/month in the optimal IDR). Because payments are based on income, whether you have $30k of debt or $300k, you pay the same monthly amount.

Improvements to the Public Service Loan Forgiveness (PSLF) Program

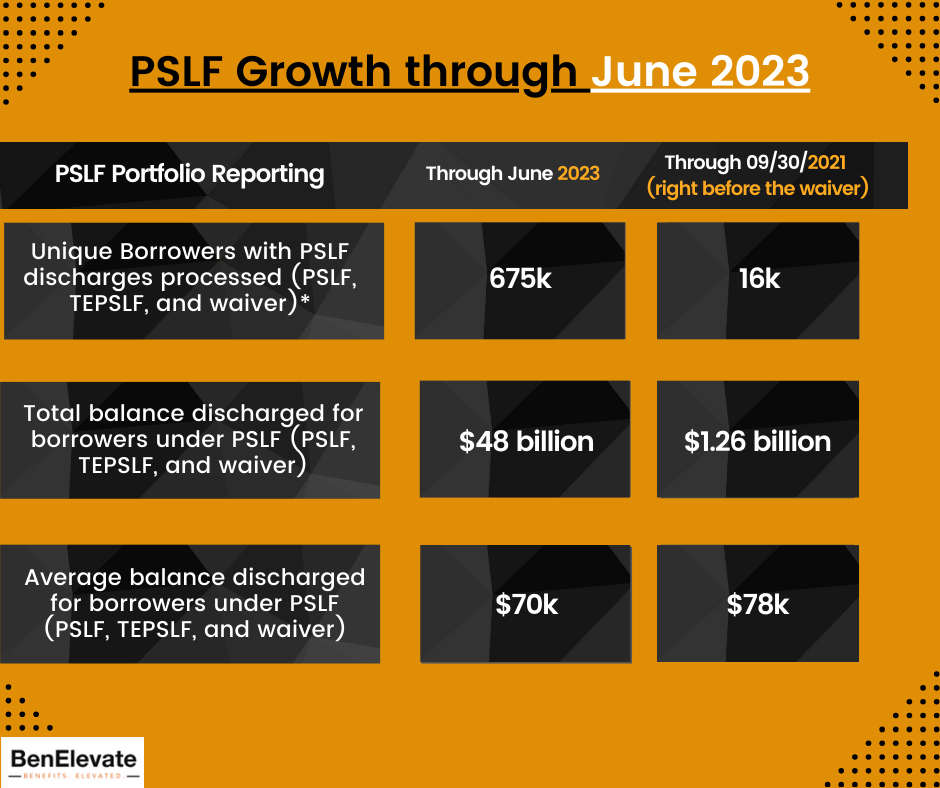

We trust that at this point, you know what PSLF is and if your employer qualifies or not. The PSLF “Limited Waiver” expired last October, but key features remain in place. The chart below indicates how both the waiver, coupled with organic growth in participation, have generated nearly $50 billion of forgiveness for 700,000 borrowers, with another 2 million borrowers in the queue today. Additionally, legislation has been passed that expands both the definition of full-time as well as what defines qualifying employment. Read more about these proposed changes here. Suffice it to say, if you weren’t considered eligible for PSLF before, you may be now…

Evolving Benefit Programs

Many hospitals are engaging resources to help their staff maximize the benefits of the PSLF program and streamline the administrative requirements. Here are a few to consider:

Refinancing: The rapid rise of interest rates over the past year, coupled with the halt of accruing interest on federal loans, all but ended private refinancing for the past three years. With interest now accumulating again, and rates leveling off presently, this opportunity will once again emerge as an option for borrowers. With graduate student loans eclipsing 8% this academic year, refinancing will again be suitable for many borrowers. BenElevate offers borrowers a tool to check available rates from multiple lenders in just two minutes: Here’s the link.

Monthly Contributions: Recent legislation permits organizations to make monthly student loan contributions where up to $5250 per year may be tax-free to the borrower. This specific benefit is emerging as a must-have for the new generation, with over 30% of employers planning to offer some level of contributions post-CARES.

Secure 2.0: Beginning in January 2024, employers who offer 401k and/or 403b matching will be able to contribute to an employee’s retirement plan based on verification of their making monthly student loan payments. This is an exciting new offering that minimally impacts budget planning and delivers substantial value to borrowers.

Meeting Equity & Inclusion Goals

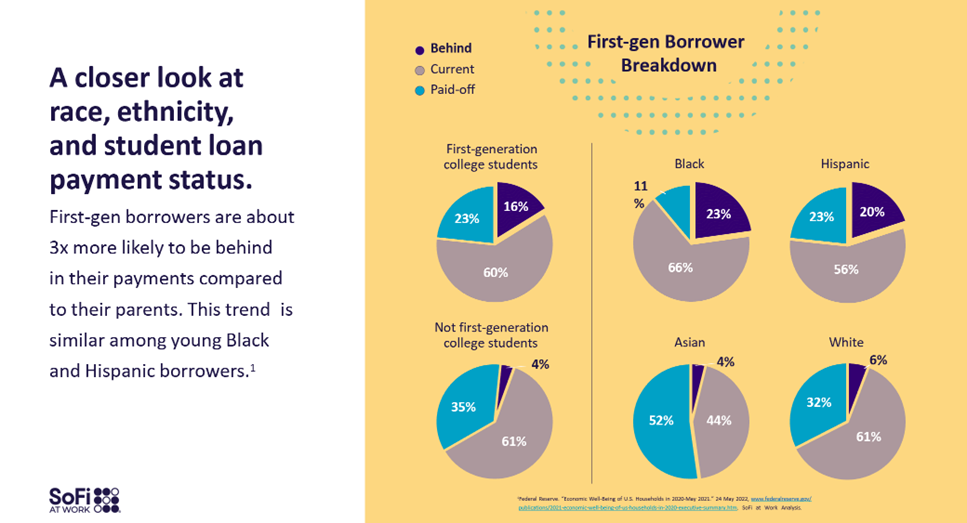

Student loan debt disproportionately impacts first generation and minority borrowers substantially, as the Sofi chart below indicates. For non-profit employers, an embedded benefit of the PSLF program is that it aligns student loan payment outcomes, regardless of a borrower’s debt level.

Example: Employee #1 has $200k in student debt and earns $90k/year in salary. The cost to eliminate her loans through PSLF is roughly $65k in IDR payments.

Employee #2 has $90k in student debt and also earns $90k/year. The cost to eliminate her debt is still$65k in IDR payments, which are based on income, not outstanding debt.

Borrowers Want Help

According to the Society for Human Resource Management, just 8% of companies offered student loan assistance in 2019. The Employee Benefit Research Institute reports that this grew to 17 percent in 2021 (during the CARES payment halt). Additionally, 31% of companies said they were planning to provide it in the future (likely referring to the end of the payment halt).

And borrowers have made it abundantly clear how much they value such benefits:

- “74% of millennials and 66% of Gen Z would prioritize working for an employer that offered student loan benefits over one that did not.“ -Fast Company

- 86% of employees ages 22 to 33 would commit to a company for five years or more if they helped to pay off their student loans

- 92% of survey takers would take advantage of a student loan payment match program if offered. -American Student Assistance Survey

Resources

An increasing number of capable resources have emerged in the marketplace to provide some or all of the benefits discussed here. BenElevate serves as an advocate to help bridge the gap that exists between borrowers and employers by delivering student loan education, free and fee-based tech-enabled resources for PSLF navigation and refinancing, and by partnering with appropriate providers to deliver other benefits.

- To quickly calculate if you’re a PSLF candidate and what your savings would be, use our “PSLF Salary Boost” tool.

- For a deeper dive into your profile, register for a PSLF Opportunity Assessment for just $50, and receive annual access to your dashboard.

- If you’re a PSLF employer and want to see a demo of our resources, schedule with us here.

Sorry, Comments are closed!