Student Loan Payments Will Resume in Late August: What We Know Right Now

If you haven’t already seen the headlines (here’s one of ‘em), student loan payment will resume later this summer. The debt ceiling deal codifies that the CARES payment halt can’t be extended again, barring a new emergency (let’s not hope for this). This means that payments will resume 60 days after June 30th… which is August 29th.

Realistically, this will likely be the day that interest starts accruing again, and it’ll take the Department of Education (ED) loan servicers some time to resume billing and related loan administration. Borrowers should expect to start making payments again in late September or early October.

It should be noted that the end of the CARES payment halt is not connected to the pending Supreme Court decision on cancelling up to $20k of student debt for borrowers under $125k single / $250k household income. This remains in play and we expect (hope) to see a decision this month.

You may have also seen the headline that the House, and then (surprisingly) the Senate, passed a bill intended to reverse the most recent payment halt extension, which could negatively affect PSLF candidates. Yes, this did happen… but the President has already said he’d veto it, and with the debt ceiling deal reached, this is likely much more symbolic than anything else.

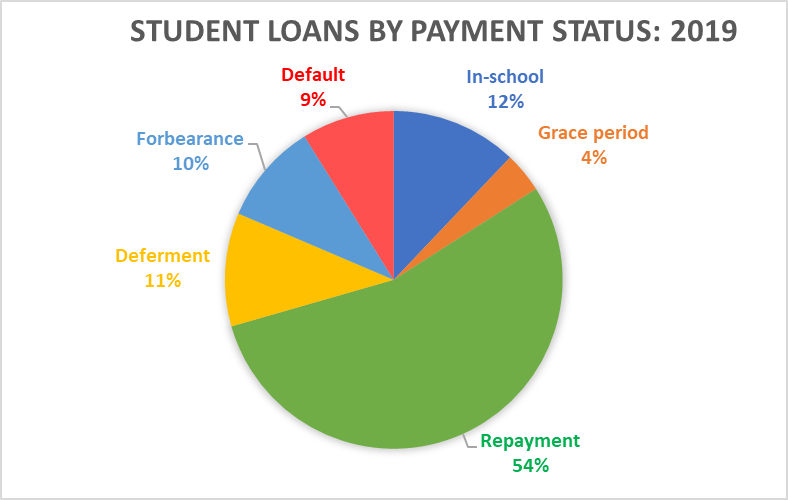

We are also seeing headlines suggesting that the resumption of student loan payments will “send 40 million borrowers into a downward spiral and push us towards economic ruin” (I’m paraphrasing several articles). Let’s put this into perspective…. if we look back to 2019, pre-CARES, 19% of borrowers were in default or forbearance. The other 81% were either still in school, in a qualified Deferment, or in repayment:

We believe that the majority of borrowers are prepared for repayment to resume, and have access to more programs providing relief now than before CARES. They have simply enjoyed an extended payment Holiday (and ideally don’t have cryptocurrency losses to show for it… but I digress.)

Lastly… the best news we’ve seen recently is NOT getting the coverage it deserves! In January, ED proposed a new Income-Driven Repayment (IDR) plan that would lower payments for all borrowers (and increase PSLF savings).

EXAMPLE: A borrower making $60k/year in a family size of 4 would have a monthly “payment” of $0 under the new plan (today, that borrower would pay roughly $100/month in the optimal IDR). Because payments are based on income, whether you have $30k of debt or $300k, you pay the same monthly amount.

Register for our free webinar series to help borrowers prepare for repayment.

EMPLOYERS: BenElevate has created both free and fee-based tech-enabled resources for employers to help their staff maximize PSLF and streamline the administrative requirements. We invite you to schedule a demo, where we can also answer any and all questions from you and your team regarding PSLF.

BORROWERS in PSLF-Qualified Roles: If you haven’t yet received a PSLF assessment to determine your savings and learn which repayment plan you should be in come September, you can register here. For those who have already registered, you can login anytime and update your information if it’s changed.

As always… ’til DEBT do us part.

Sorry, Comments are closed!